Sirius XM Holdings (SIRI) has seen its shares drift slightly over the past week, with the stock posting modest moves. Investors may be watching for signs of momentum as it navigates a competitive media landscape.

See our latest analysis for Sirius XM Holdings.

The latest share price of $21.51 reflects only a slight dip over the past week, but it is part of a longer-term trend, with the one-year total shareholder return showing a notable decline of 12.5%. While short-term movements have been relatively muted, this signals that momentum has been fading over recent quarters. This puts the spotlight on how Sirius XM is positioned for future opportunities or headwinds.

If today’s moves have you thinking about what else the market has to offer, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares down over the past year even as earnings edge higher, could Sirius XM be trading below its true value? Alternatively, has the market already anticipated any potential upside in its outlook?

Most Popular Narrative: 10.4% Undervalued

Sirius XM Holdings’ current share price is notably below the narrative’s fair value estimate, giving bulls and value-seekers something to consider as upcoming results approach. Here, the focus moves beyond surface-level pricing to the drivers powering this optimistic scenario.

SiriusXM is expanding its suite of in-car and digital subscription offerings, notably with the launch of the new ad-supported SiriusXM Play plan. By aiming to tap into a pool of up to 100 million vehicles and reach more price-sensitive listeners, this expanded addressable market and improved packaging is likely to boost revenue and support subscriber growth in 2026 and beyond.

Want to know which spicy projections are behind this bullish call? The narrative hinges on a striking transformation in future earnings, profit margins, and market reach. Find out which bold growth assumptions push this valuation and whether the numbers justify the hype.

Result: Fair Value of $24.00 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, continued subscriber declines or a slowdown in advertising revenue could quickly undermine the bullish case and negatively impact future performance.

Find out about the key risks to this Sirius XM Holdings narrative.

Another View: Market Ratio Signals Caution

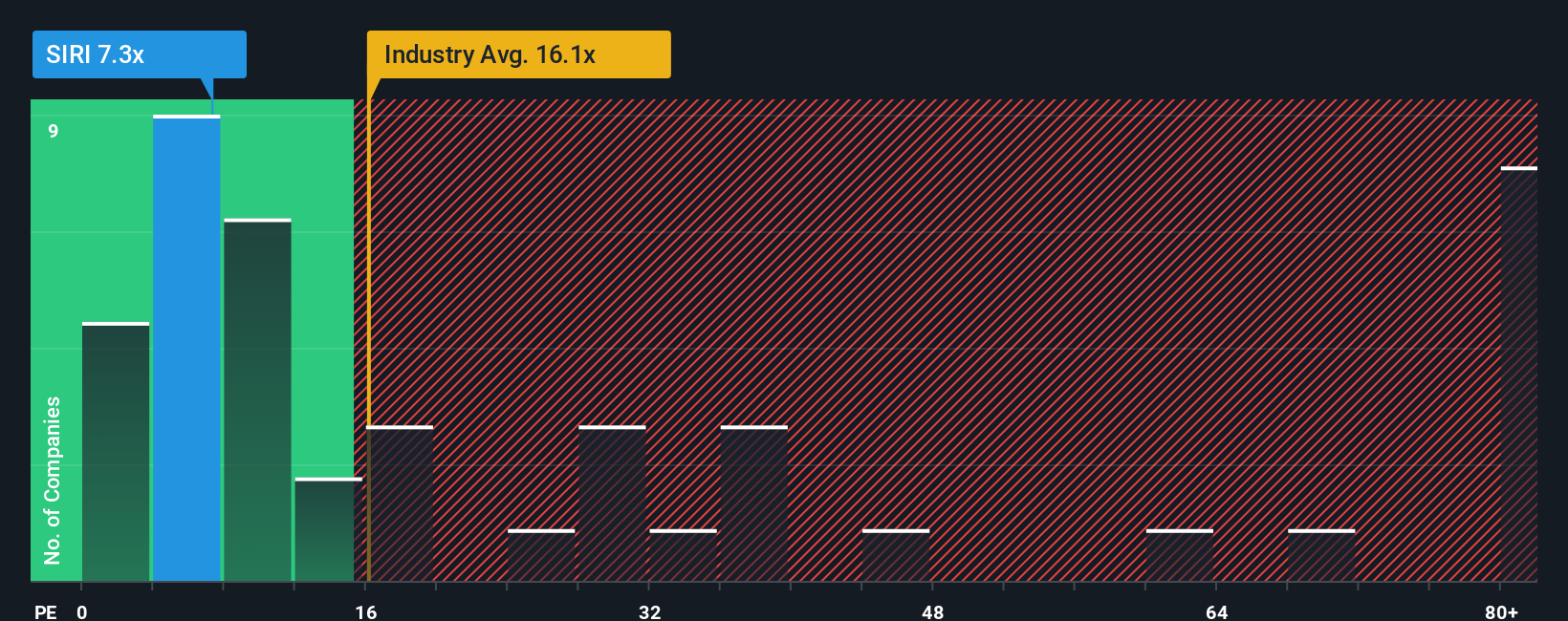

While some see Sirius XM as undervalued, a closer look at its price-to-earnings ratio tells a different story. At 7.3×, the ratio looks higher than its closest peers at 5.3×. However, it is still much lower than the US Media industry average of 16.1×. Interestingly, our analysis suggests the fair ratio could be as high as 17.6×. This gap hints that the stock is trading at a discount compared to the broader industry. Yet, it also appears expensive versus direct competitors. Could this mean hidden value, or does it point to underlying risks the market is already pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sirius XM Holdings Narrative

If the perspective shared here doesn’t quite fit your view, or you want to follow your own research path, you can craft a unique story for Sirius XM Holdings in just a few minutes – Do it your way.

A great starting point for your Sirius XM Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay a step ahead, so do not limit yourself to just one opportunity. Power up your portfolio by tapping into other top-performing trends on Simply Wall Street.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com