Surprisingly, it turns out we’ve “misjudged” Lei Jun.

Let’s rewind to October 24th, the day when the Redmi K90 series was launched. Two executives, Lei Jun and Lu Weibing, poured out their grievances on social platforms, saying that the price increase of the K90 series was a “last resort” because the price of memory had skyrocketed. They asked for everyone’s understanding.

Here’s the situation. The standard version of the Redmi K90 is priced at 2,599 yuan, 300 yuan more expensive than its predecessor. If you want to upgrade from the 256GB version to the 512GB version, you need to pay an additional 600 yuan (3,199 yuan), while the previous generation only required an extra 400 yuan.

Every time a new product is launched, they claim that high costs force a price increase, and then they cut the price by a few hundred yuan during the initial sales, creating an impression of “being very generous”… To be honest, consumers are quite familiar with this “complaining-style marketing” and are tired of it.

Unexpectedly, after entering November, the soaring memory prices became a top – headline news. The computer market was hit first. The price of memory modules changes every day. The price of the same – spec module has risen from 200 yuan a month or two ago to 400 – 500 yuan. The price of solid – state drives has doubled directly. The increase rate outperforms that of gold.

The mobile phone industry was not spared either. According to media reports, many mobile phone manufacturers are bearing the cost pressure caused by the rising memory prices. Some have even had to postpone the procurement of storage chips this quarter.

Currently, the material inventories of manufacturers such as Xiaomi, OPPO, and vivo are generally less than two months. To ensure future shipments, they may have to accept a nearly 50% price increase from upstream suppliers.

After the news spread like wildfire, we realized that Lei Jun and Lu Weibing’s “complaints” might actually be true this time.

However, it’s puzzling that the memory price increase has been going on for the past two years without causing any obvious impact. Why did it suddenly turn into a “cost disaster” in the tech circle in November?

It’s all Nvidia’s fault.

The Trouble Caused by “Being Too Good at Making Money”

Jensen Huang, who is involved in AI and sells graphics cards, seems to have nothing to do with memory manufacturing, let alone mobile phone manufacturers. So how did he turn the entire tech circle upside down?

In a nutshell, the wafer production capacity is limited, while the demand for AI is extremely crazy.

Actually, the core storage units of memory on different platforms, such as DDR5 (for computers), LPDDR5 (for mobile phones), and HBM (for AI), are essentially the same DRAM chips.

They all have to be produced on the same high – precision production line, using the same ASML EUV lithography machine to engrave circuits on silicon wafers.

The production line and wafers are like the “golden flour” with a limited daily supply. There are only a few “shops” in the world that can produce them, and the overall amount is fixed. There’s no way to increase the supply.

In the past, upstream original manufacturers like Samsung, SK Hynix, and Micron might have used 90% of the “flour” to produce memory for mobile phones and computers, and the remaining 10% for server memory.

However, the situation has changed. After Jensen Huang became the de – facto AI hardware king, almost all companies around the world are buying AI computing cards and computing power servers from him. As more and more cards are sold, the demand for HBM memory on the computing cards has exploded.

Moreover, not only is the total amount of the “flour” (wafer supply) from the wafer factories fixed, but producing high – end HBM is both labor – intensive and extremely material – consuming.

The wafer area consumed to produce one HBM chip could originally be used to cut out three ordinary mobile phone memory chips.

But the original manufacturers still unhesitatingly allocate all the “flour” to Jensen Huang. Why? Because the profit gap is so large that capital can’t resist it.

According to the research data of Goldman Sachs, Morgan Stanley, and TrendForce from 2024 – 2025, when selling the same 1GB of capacity, the net profit that HBM brings to the original manufacturers is 5 to 10 times that of mobile phones.

Take the most straightforward example: The latest Nvidia H200 graphics card is equipped with 141GB of HBM3e video memory. For original manufacturers like Samsung or SK Hynix, the net profit from selling the video memory required for this one graphics card to Jensen Huang is roughly equivalent to the total profit from selling 5,000 Redmi K70 mobile phones.

Nvidia released its latest financial report early on the 20th. The revenue in the entire third quarter reached a new record of 57 billion US dollars. As Jensen Huang said, “The sales of the Blackwell series of chips are rising steadily, and the cloud GPUs are sold out,” which actually represents the booming demand for millions of HBM chips.

On one hand, there are AI giants willing to pay a premium to buy. On the other hand, there are mobile phone manufacturers haggling over every penny. It’s easy to understand why the original manufacturers prefer to allocate production capacity to HBM.

Do mobile phone manufacturers think it’s too expensive? It’s better not to buy. On one hand, the original manufacturers don’t worry about sales. On the other hand, they can justifiably allocate all the production capacity to HBM.

So, the price increase of Redmi is not because Xiaomi wants to make more money, but because Nvidia is too good at making money.

Apple and Huawei, Standing Out

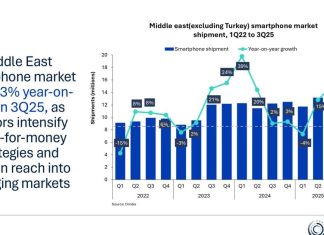

In this tsunami of storage price increases triggered by AI, the water has reached everyone’s ankles. However, compared to the “sob stories” of mobile phone manufacturers, what people are more concerned about is what the mobile phone market will look like next year?

Judging from the current situation, the market will be “polarized” next year. To put it simply, high – premium brands will be “relaxed”, while cost – effective brands will be “struggling”.

For high – premium brands, just look at Apple. For Tim Cook, this wave of storage chip price increases is probably just an insignificant “error” in the financial report. Why? Because of Apple’s “golden memory”.

It’s like luxury handbags in a store. Will a 20% increase in leather raw material prices affect the price of a 30,000 – yuan handbag? Definitely not.

Take a look at Apple’s pricing strategy. If you want to upgrade the storage of the iPhone 17 Pro Max from 256GB to 512GB, how much more do you need to pay? 2,000 yuan.

But in fact, even with the current price increase, the procurement cost of the additional 256GB of flash memory may only increase by less than 100 yuan.

Apple has already reserved a terrifying profit margin of up to 10 or even 20 times for storage upgrades, leaving a buffer space as vast as the Sahara Desert for cost increases.

Now look at Huawei. As the only domestic high – end brand, Huawei’s current strategy is similar to Apple’s. The Mate series and Pura series are no longer just about “specs stacking”. They are about brand influence, the HarmonyOS ecosystem, and a certain degree of emotional premium.

Huawei’s high – end models have a sufficient profit safety cushion. In the face of rising memory prices, Huawei can either absorb the cost internally or make minor adjustments to other high – perception modules such as imaging and communication to balance the material cost.

For users who buy Huawei’s high – end models, they are relatively less sensitive to price. As long as the experience doesn’t decline, Huawei doesn’t have the hard – line pressure to increase the price.

In short, users of Apple and Huawei don’t need to worry about price increases next year. The ones really suffering are those brands closely associated with cost – effectiveness, such as the Xiaomi family mentioned above, as well as OPPO and Honor.

This is the other end of the “polarization”. As Xiaomi’s business model is that “the comprehensive net profit margin of hardware does not exceed 5%”, it means that its mobile phones are almost sold at cost price.

For Apple, a 50 – yuan increase in memory price is a “piece of cake”. But for Xiaomi, which has to stretch every penny, this 50 – yuan cost increase directly breaks through its profit bottom line.

This is why we saw that Xiaomi’s executives were the first to announce a “price increase”, while Apple and Huawei remained silent.

Where is the End of the Price Increase?

However, consumers don’t really care about the cost of mobile phone manufacturers. What they are more concerned about is although the media has been hinting at a price decrease, no media can give an exact figure on how much the price will actually increase.

Actually, several models this year have already given a heads – up about the price increase.

For flagship models, take a look at the flagships of OV this year. For example, the price of the vivo X300 series has been increased by 100 – 300 yuan, and the OPPO Find X9 has been increased by 200 – 300 yuan.

For mid – to low – end mass – market models, look at Redmi and the sub – brands of other manufacturers. For example, the Redmi K90 series has increased by 300 – 600 yuan compared to the previous generation, and the realme GT8 has increased by 300 – 500 yuan.

TrendForce, a professional institution, predicts that considering that memory accounts for about 10% – 15% of the mobile phone hardware cost, and the DRAM price has increased by more than 75% year – on – year in 2025, the overall terminal selling price will increase by 5% – 15% in 2026.

That means, on average, buying a mobile phone next year will cost about 500 yuan more than this year.

However, what makes people more vigilant than a simple price increase is the “stealthy reduction” of configuration.

As Lu Weibing said in the conference call of Xiaomi’s third – quarter financial report, “Increasing the mobile phone price cannot fully offset the pressure caused by the soaring memory cost.”

So what to do? Mobile phone manufacturers say, reduce the configuration then.

This is actually a quite common practice at present. According to the statistics of the self – media @Xiaoyipingkeji, among a large number of new models launched in the second half of this year, almost all of them have experienced a reduction in configuration.

The scariest one is the OnePlus 15 series, which has a total of 13 configuration reduction items, making it the king of configuration reduction this year. The second – ranked Xiaomi 17 Pro and the third – ranked Redmi K90 Pro Max have 8 and 6 configuration reduction items respectively. Note that the Redmi K90 Pro Max is a model whose starting price has increased by 300 yuan.

Moreover, some of the configuration reductions can significantly affect the user experience, such as screen resolution, camera configuration, and vibration motor.

The large – scale configuration reduction is not an “isolated case” that emerged only in the second half of this year. It reflects a market trend: The good days of spec – stacking and intense competition among manufacturers are really coming to an end.

Ultimately, due to the rising costs, in order to maintain a reasonable profit margin or the “cost – effectiveness” label, manufacturers are sacrificing user experience to fill the cost gap.

This is the most realistic and cruel picture of the mobile phone market in the next two or three years.

So, how long will this round of mobile phone price increase last?

It depends on how long the memory price will keep rising.

Generally, the storage industry has a cycle of “two years of increase and two years of decrease”. This round of memory price increase started in 2023 – 2024. Logically, it should end at the end of 2025 to the beginning of 2026 due to the increase in storage product inventory and enter the price – decline cycle.