Informatica (INFA) has been drawing some attention lately, as investors weigh its recent performance and underlying fundamentals. With a year-to-date return slightly negative and modest revenue growth, there is fresh debate about how the stock stacks up in the software sector.

See our latest analysis for Informatica.

Looking at the bigger picture, Informatica’s share price has drifted lower in recent months, reflecting a cautious mood after a period of modest gains. Despite this, its three-year total shareholder return remains a solid 31%, which underscores long-term resilience even as near-term momentum tapers off.

If you’re keeping tabs on what’s next in software, it might be the perfect moment to discover See the full list for free.

With shares drifting and fundamentals showing both strengths and weaknesses, the big question is whether Informatica is trading at a bargain compared to its future prospects, or if the current price already factors in all expected growth.

Most Popular Narrative: Fairly Valued

The consensus narrative pegs Informatica’s fair value at $24.40, just cents off its last trade. For investors, this signals a market in near-perfect alignment with future expectations.

*Informatica’s transition to a cloud-only strategy is expected to enhance long-term revenue through increased upsell and cross-sell opportunities on the IDMC platform, despite short-term revenue impacts due to subscription credits during migrations. The anticipated growth of cloud subscription ARR, aiming to reach the $1 billion milestone in 2025, is expected to drive future earnings. Cloud subscriptions are projected to account for nearly 60% of total ARR by the end of the year.*

Curious which financial leap could justify this price? There’s a bullish blueprint here, driven by new business models and rapid subscription growth. The key ingredients shaping this fair value may not be what you expect. Discover the surprising combination of catalysts and forecasts that tip the balance.

Result: Fair Value of $24.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing uncertainty around renewal execution and the impact of shorter subscription terms could quickly challenge the optimistic assumptions built into current valuations.

Find out about the key risks to this Informatica narrative.

Another View: Multiples Tell a Different Story

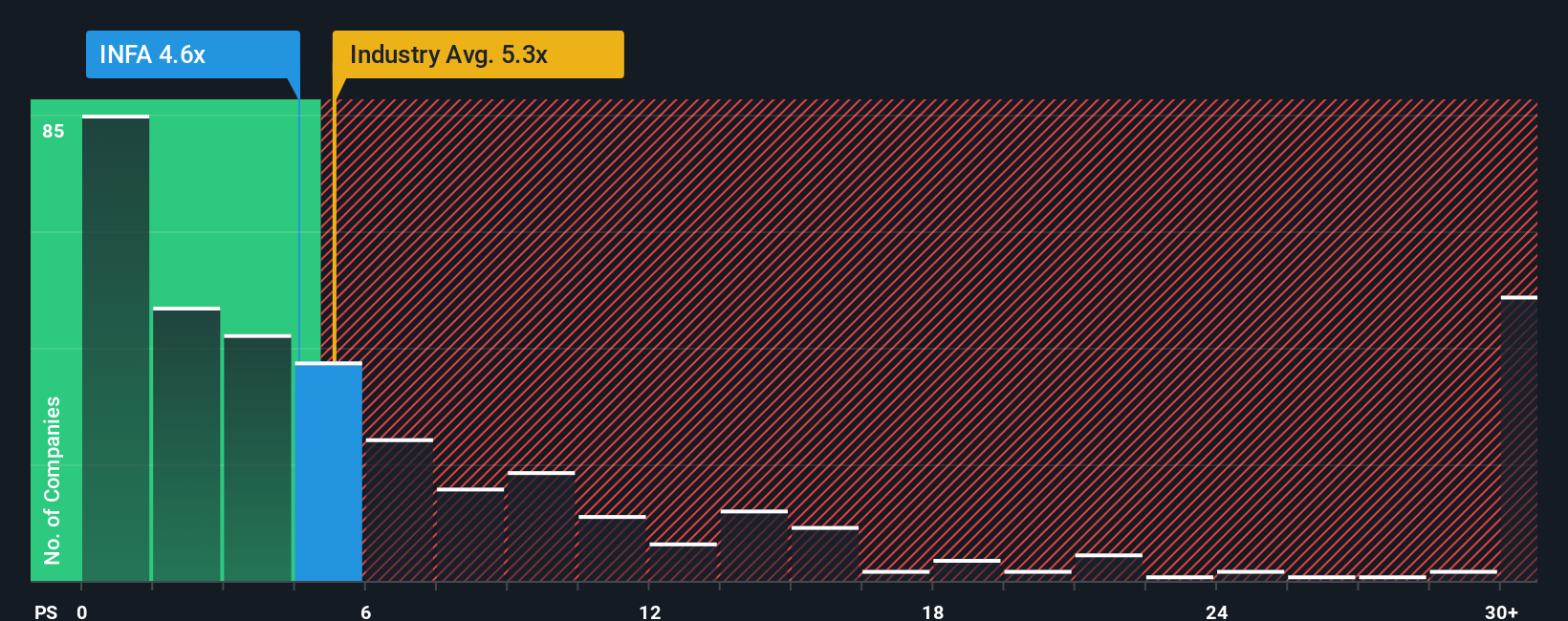

Taking a look through the lens of price to sales, Informatica stands out as good value. Its 4.6x ratio comes in below both the software industry average of 4.9x and the peer average of 6.5x. Notably, it is also trading beneath the fair ratio of 5.4x, suggesting some margin of safety. But does this lower multiple reflect a real opportunity, or is the discount a warning sign about growth risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Informatica Narrative

If you see room for a different conclusion or want to put your own research to the test, shaping a custom narrative takes just minutes: Do it your way

A great starting point for your Informatica research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to spot smart moves beyond Informatica? Uncover opportunities in fast-growing areas right now with these carefully selected lists. Don’t let the next big winner slip by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com