European markets have recently experienced a pullback, with major indexes such as the STOXX Europe 600 Index ending lower amid concerns about overvaluation in artificial intelligence-related stocks. Despite these broader market challenges, there remains a niche of investment opportunities within penny stocks. Though often seen as relics of past trading days, penny stocks—typically smaller or newer companies—can still offer significant growth potential when they possess strong financial foundations.

Top 10 Penny Stocks In Europe

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Let’s dive into some prime choices out of the screener.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ELES Semiconductor Equipment S.p.A. designs, manufactures, and sells test equipment and services for the semiconductor industry both in Italy and internationally, with a market cap of €47.06 million.

Operations: The company’s revenue is primarily generated from its Semiconductor Equipment and Services segment, which accounted for €34.41 million.

Market Cap: €47.06M

ELES Semiconductor Equipment S.p.A. presents a mixed picture as a penny stock investment. The company is currently unprofitable, with increased losses over the past five years, and its recent earnings report showed decreased revenue and a net loss. However, it maintains a satisfactory net debt to equity ratio of 16.8% and has reduced its debt levels over time. Short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. A proposed acquisition by Mare Engineering Group S.p.A., expected to complete in January 2026, could potentially reshape ELES’s financial landscape if regulatory approvals are met.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharma and biotech industries in Europe and the United States, with a market cap of €92.35 million.

Operations: The company generates €3.95 million in revenue from its expert services in nanotechnology and drug particle engineering.

Market Cap: €92.35M

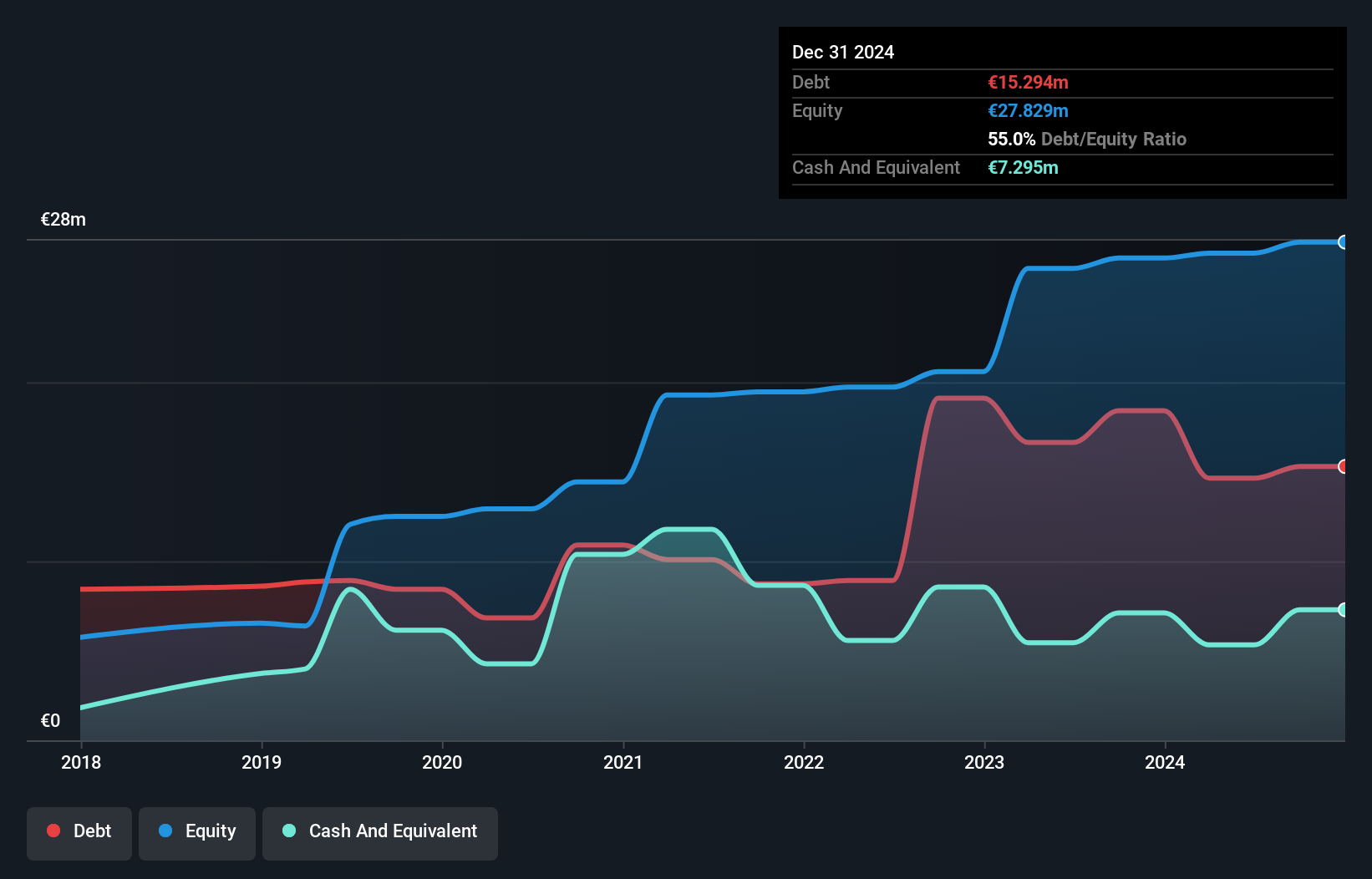

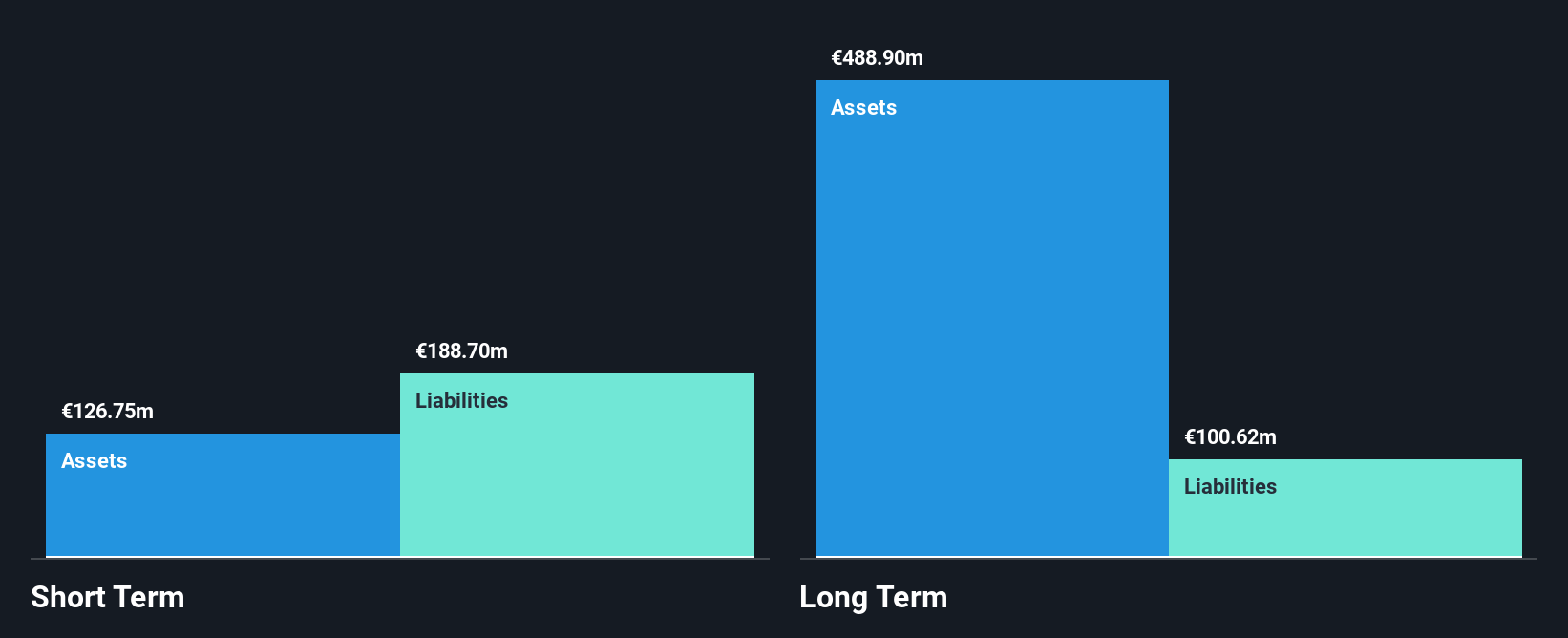

Nanoform Finland Oyj’s recent strategic alliance with Revio Therapeutics to co-develop GLIORA, a promising nano-formulated treatment for high-grade glioma, highlights its innovative edge in nanotechnology. Despite being unprofitable and having limited revenue (€4M), the company benefits from strong liquidity, with short-term assets significantly exceeding liabilities. Nanoform’s seasoned management and board enhance its operational stability. The company’s cash runway is sufficient for over a year, even as it navigates high share price volatility. While not forecasted to achieve profitability soon, partnerships like that with Revio could bolster future revenue streams.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien, along with its subsidiaries, operates in the football business in Germany and has a market cap of approximately €373.63 million.

Operations: The company’s revenue is primarily generated through Borussia Dortmund Kgaa with €528.66 million, followed by BVB Merchandising GmbH at €42.90 million, and BVB Event & Catering Gmbh contributing €38.27 million.

Market Cap: €373.63M

Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien’s financial landscape reveals a mixed picture for investors in penny stocks. The company has maintained stable weekly volatility and its debt is well covered by operating cash flow, though short-term liabilities exceed assets. Despite a satisfactory net debt to equity ratio, recent earnings have declined significantly from €44.31 million to €6.5 million year-over-year, impacting profit margins negatively from 7.3% to 1.2%. While analysts anticipate future earnings growth of 17.77% annually, the dividend remains inadequately covered by current earnings and free cash flows, reflecting potential constraints on shareholder returns amidst these challenges.

Summing It All Up

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nanoform Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com