- Ever wondered if Analog Devices is actually worth its current share price, or if the market is just caught up in the excitement? You are not alone. Today we will cut through the noise to get some answers.

- While the stock is up 3.0% over the past month and has delivered a solid 9.8% gain year to date, longer-term returns show an 83.6% rise over five years and 51.7% over the past three years, but only 7.0% in the last twelve months.

- Industry chatter has been buzzing about Analog Devices as it continues to expand its presence in cutting-edge industrial and automotive applications. Recent headlines point to strategic partnerships and innovations that could shape its future trajectory and stir up investor interest.

- On our valuation scorecard, Analog Devices scores just 1 out of 6 when assessing undervaluation across six key metrics. Next, we will break down these valuation checks and explore the usual approaches. Stick around because there is an even smarter way to understand what the numbers really mean for investors.

Analog Devices scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Analog Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach gives a present value for all the cash Analog Devices is expected to generate, allowing investors to see how today’s price compares with those expectations.

Analog Devices currently generates Free Cash Flow (FCF) of $3.33 billion. Over the next decade, analysts forecast steady growth, with FCF expected to reach approximately $7.69 billion by 2029. While analyst consensus covers only the first five years, further projections are provided by Simply Wall St, showing a continued upward trend in cash generation.

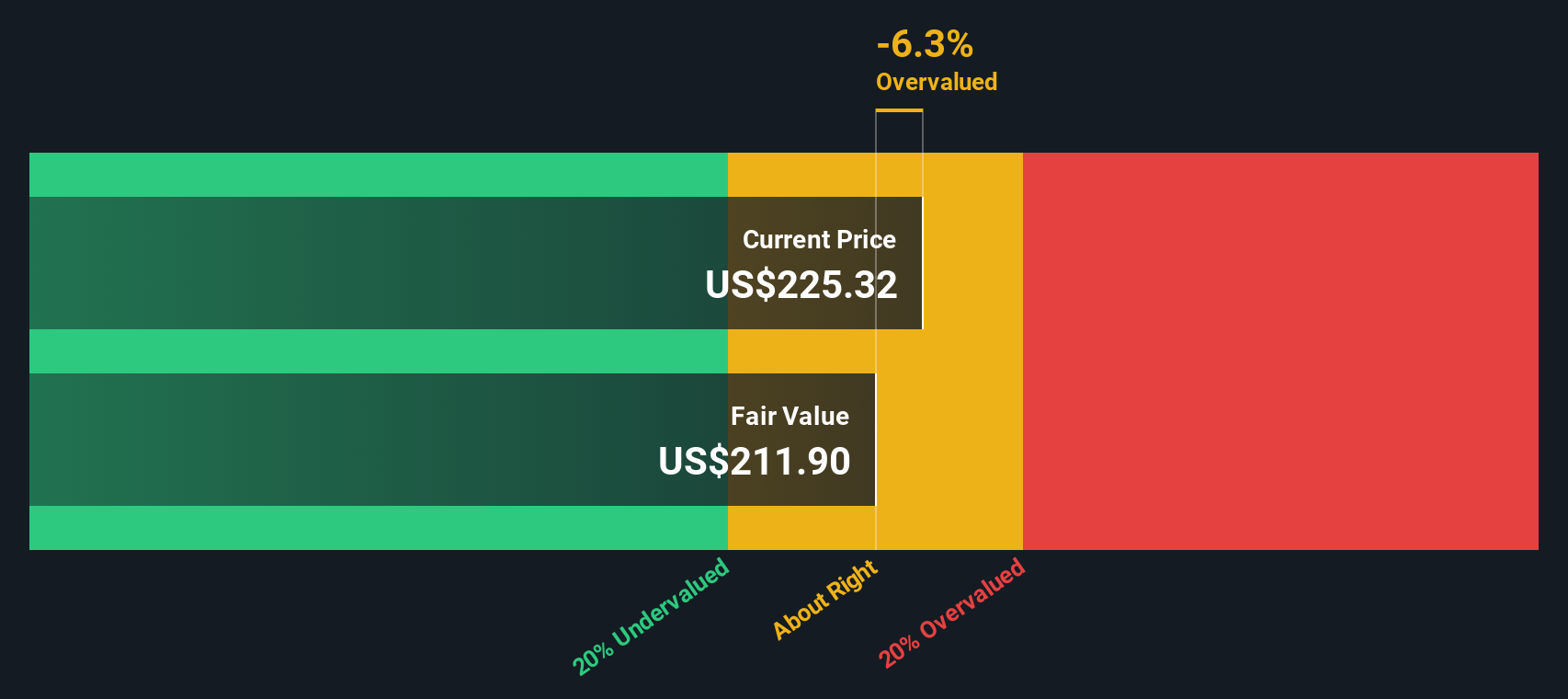

Bringing these future cash flows back to present value, the DCF model assigns Analog Devices an intrinsic value of $204.44 per share. However, the stock’s current trading price is about 13.5% above this estimate, suggesting that investors today are paying more than what the long-term cash flows justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Analog Devices may be overvalued by 13.5%. Discover 865 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Analog Devices Price vs Earnings

When evaluating profitable companies like Analog Devices, the price-to-earnings (PE) ratio is a popular and practical valuation tool. This metric tells investors how much they are paying for each dollar of earnings, making it especially useful for companies with consistent profits.

However, what counts as a “fair” PE multiple depends on several factors. Companies with higher expected growth or lower risk profiles generally deserve higher PE ratios. Mature or riskier businesses often command lower ones.

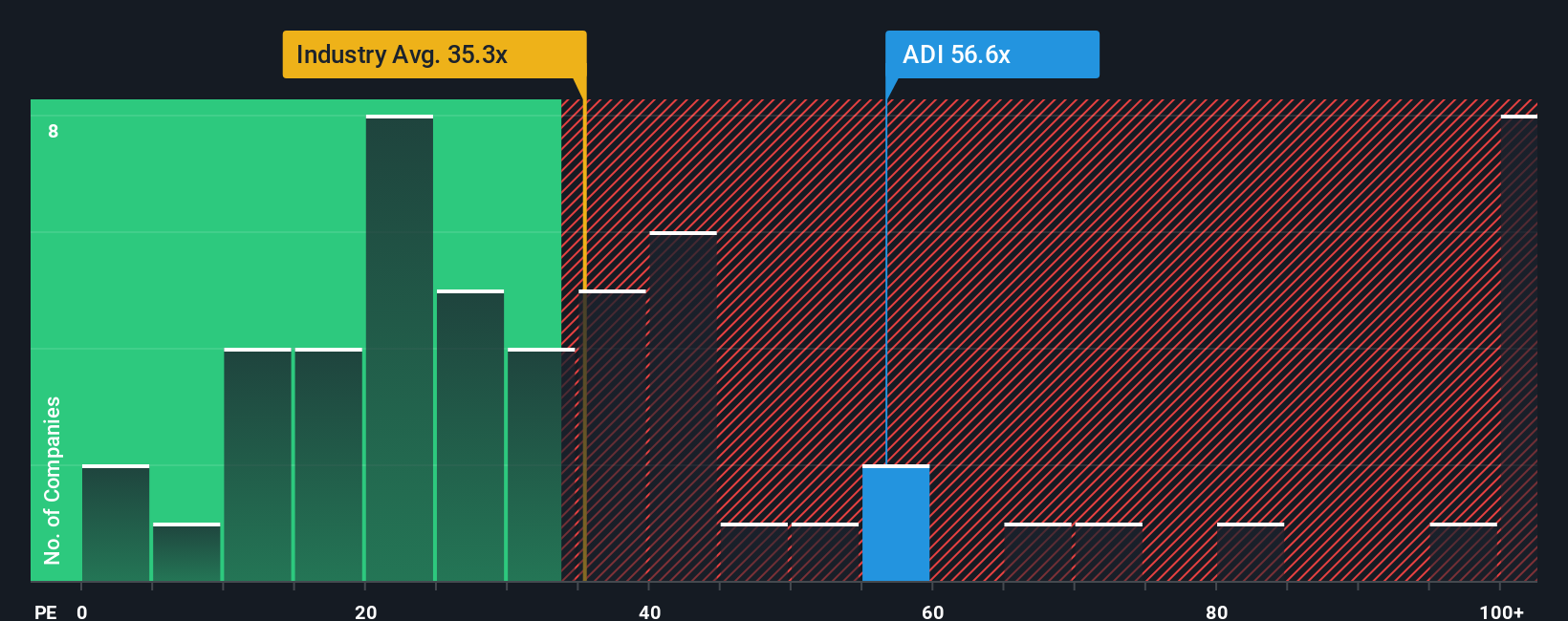

Analog Devices currently trades at a PE ratio of 58.3x. That is well above the semiconductor industry average of 36.4x, but actually below the peer average of 71.3x. At first glance, this could make the stock look expensive relative to the broader industry, yet more attractively priced compared to its closest competitors.

To provide more nuanced context, Simply Wall St’s Fair Ratio is 41.5x for Analog Devices. Unlike a basic industry comparison, the Fair Ratio factors in the company’s specific growth prospects, profit margins, risk profile, as well as its industry sector and market cap. This makes it a more comprehensive yardstick than simply comparing to peers or sector averages.

Since Analog Devices’ current PE is noticeably higher than the Fair Ratio, it suggests that the stock is trading above a valuation justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Analog Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is the story behind the numbers. It is your perspective on a company’s future and how those beliefs shape your estimated fair value, including expectations for revenue, earnings, and profit margins.

With Narratives, you connect what is happening in Analog Devices’ business and industry directly to a financial forecast and to an actionable fair value. Narratives are easy to use and available on Simply Wall St’s Community page, where millions of investors share and update their views. By building or exploring Narratives, you can see at a glance whether the current share price is above or below your calculated fair value, helping you decide when to buy, hold, or sell.

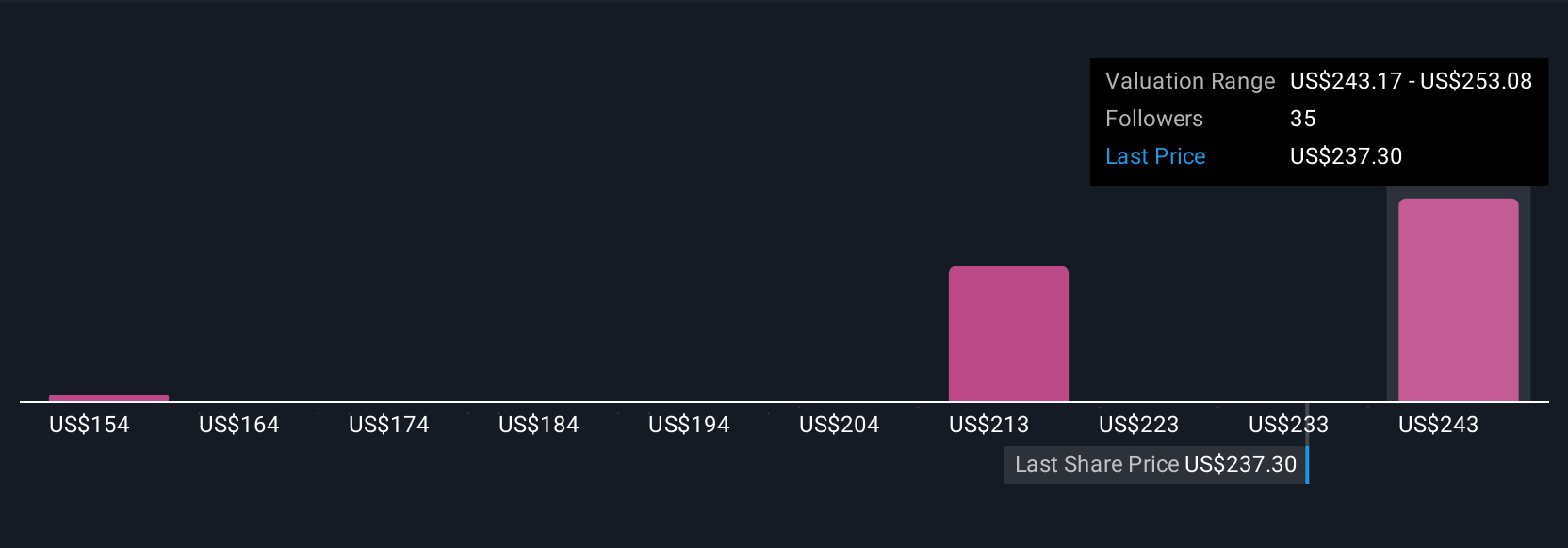

Because Narratives are updated automatically as new data, news, or earnings come out, your investment thesis stays current without any manual effort. For example, some investors are bullish on Analog Devices, forecasting future earnings as high as $4.9 billion and a fair value up to $310, while more cautious views expect earnings closer to $3.4 billion and a fair value as low as $155.

Do you think there’s more to the story for Analog Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com