- Goldman Sachs recently upgraded AutoZone from Neutral to Buy, highlighting renewed analyst optimism regarding the company’s financial strength and market position in the automotive aftermarket sector.

- This upgrade comes as financial institutions display increased interest, with a rise in large options trades and positive analysis, despite AutoZone’s recent underperformance relative to peers and mixed quarterly results.

- We’ll examine how heightened analyst confidence from the Goldman Sachs upgrade influences AutoZone’s investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

AutoZone Investment Narrative Recap

To invest in AutoZone, you need confidence in its ability to grow market share within the aftermarket auto parts sector by leveraging a wide store network and reliable supply chain. The Goldman Sachs upgrade signals renewed short-term optimism but does not fundamentally shift the biggest near-term catalyst, expansion of Mega-Hub locations, nor does it materially alter the primary risk of ongoing inflationary pressures impacting consumer demand and sales volumes.

Among recent announcements, AutoZone’s commitment to opening at least 19 additional Mega-Hub locations stands out, as these large facilities are intended to boost product availability and support growth in both retail and commercial segments, reinforcing a catalyst that is central to current investor optimism.

Yet, despite analyst upgrades, investors should still watch for signs that persistent inflation could suppress transaction volumes and affect margins…

Read the full narrative on AutoZone (it’s free!)

AutoZone’s narrative projects $22.5 billion revenue and $3.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.5 billion earnings increase from $2.6 billion currently.

Uncover how AutoZone’s forecasts yield a $4583 fair value, a 19% upside to its current price.

Exploring Other Perspectives

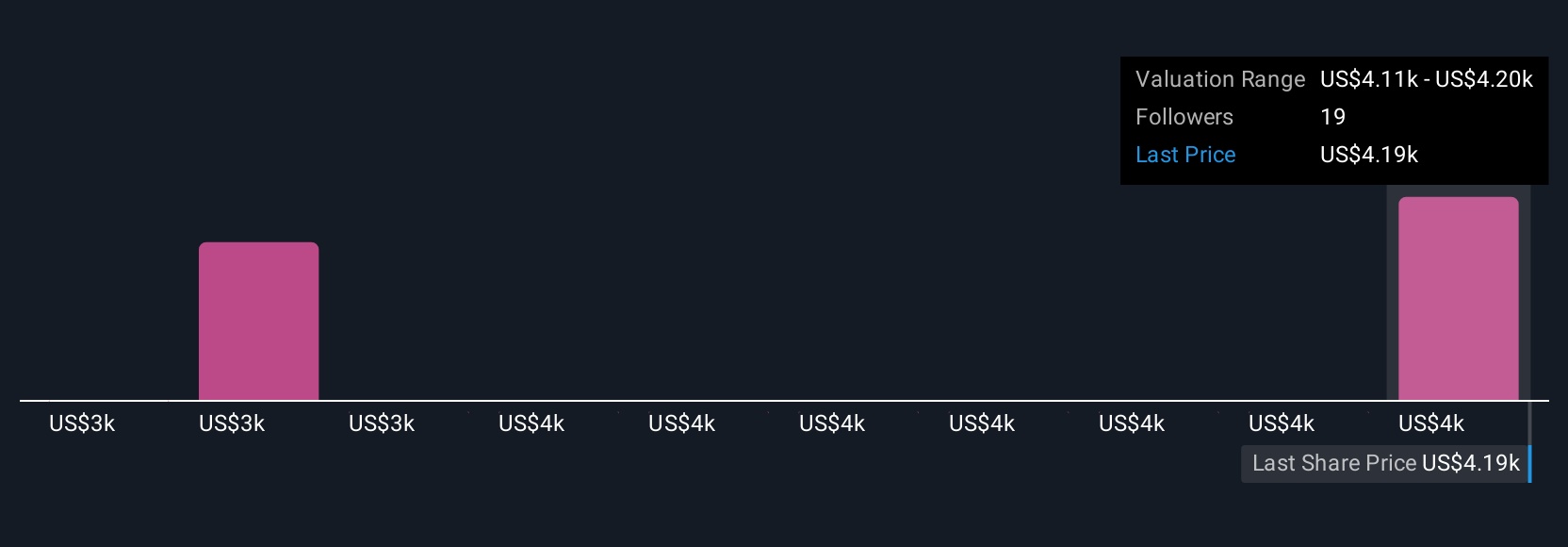

Private investors in the Simply Wall St Community estimated fair values for AutoZone between US$3,330 and US$4,583 based on their own projections. While opinions vary, many see ongoing inflation as a challenge that could test the company’s growth strategies and resilience.

Explore 2 other fair value estimates on AutoZone – why the stock might be worth as much as 19% more than the current price!

Build Your Own AutoZone Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com