Opportunities in the Australian footwear market include catering to rising demand for athleisure and sustainable shoes, leveraging strong online retail channels, and capitalizing on trends in customization and personalization. Brands can innovate to address local preferences while competing in a saturated market.

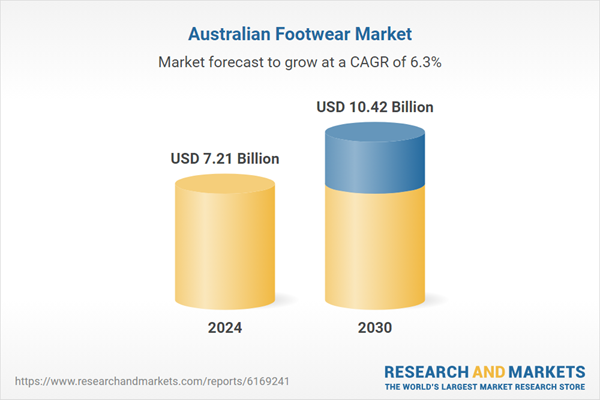

Australian Footwear Market

Dublin, Nov. 18, 2025 (GLOBE NEWSWIRE) — The “Australia Footwear Market by Region, Competition, Forecast & Opportunities, 2020-2030F” report has been added to ResearchAndMarkets.com’s offering.

The Australia Footwear Market was valued at USD 7.21 Billion in 2024, and is projected to reach USD 10.42 Billion by 2030, rising at a CAGR of 6.33%

The Australia footwear market is experiencing steady growth, driven by rising disposable incomes, urbanization, and increasing consumer interest in fashion and comfort. A strong emphasis on lifestyle and wellness has fueled demand for versatile and athleisure footwear, while eco-conscious consumers are propelling growth in sustainable and ethically produced shoes.

The market is also benefitting from a robust online retail landscape, enabling brands to reach wider audiences through digital platforms. International brands continue to gain traction, but domestic players are innovating to cater to evolving local preferences. Seasonal trends, coupled with a growing inclination toward customized and premium footwear, are influencing purchasing decisions.

Key Market Drivers

Rising Health and Fitness Consciousness Driving Demand for Athletic and Casual Footwear

The growing emphasis on health, wellness, and physical activity among Australians has significantly propelled the demand for athletic and sports-oriented footwear. Fitness participation remains high, with over 585,000 gym members in Australia and New Zealand under the Fitness & Lifestyle Group – reporting 5% sales growth. With a sharp increase in gym memberships, participation in outdoor sports, and adoption of active lifestyles, consumers are prioritizing comfortable and performance-oriented shoes. Footwear brands have responded by offering high-performance running shoes, walking sneakers, and athleisure wear that cater to both function and style.

Government initiatives promoting physical activity, along with the popularity of fitness trends like Pilates, yoga, and CrossFit, have contributed to this rising demand. Additionally, the blending of athletic elements into everyday fashion has given rise to the “athleisure” trend, where sneakers and trainers are worn not just for workouts but also in casual settings. This shift has expanded the target audience for sports footwear, making it a mainstream fashion staple. Key players are collaborating with fitness influencers and athletes to push limited-edition releases and performance lines, further increasing the market appeal. As consumers continue to prioritize wellness in their lifestyles, the demand for athletic and multi-purpose footwear is expected to remain strong across demographics and age groups.

Key Market Challenges

Intense Market Competition and Brand Saturation

One of the foremost challenges in the Australian footwear market is the high level of competition and brand saturation, which makes it increasingly difficult for new and existing players to differentiate themselves. The market is flooded with international brands such as Nike, Adidas, Skechers, and Puma, alongside a growing number of domestic labels and private-label brands offered by major retailers. This saturation results in frequent price wars, heavy discounting, and promotional campaigns that erode profit margins and make sustained brand loyalty difficult to achieve.

Smaller and mid-sized companies struggle to secure retail shelf space or online visibility, as dominant players continue to capture consumer attention through aggressive marketing, influencer collaborations, and global fashion trends. As consumer preferences shift rapidly – fueled by fast fashion and the influence of social media – brands are forced to release more frequent collections, adding further pressure to supply chains and design cycles.