Coinbase Global (COIN) shares have recently seen a shift in momentum as crypto sector volatility and trading volume trends continue to impact the company’s financial outlook. Investors are closely watching Coinbase’s performance as the digital asset markets continue to experience changes.

See our latest analysis for Coinbase Global.

This year’s momentum for Coinbase Global has shifted noticeably, with the stock recording a 2.62% year-to-date share price return amid sharp swings. A notably weak recent stretch, including a 21.45% drop in the last month, has contrasted with the company’s standout 540% total shareholder return over three years. This illustrates just how quickly sentiment and risk perception can change in the crypto space.

If you’re curious about what else is trending beyond crypto, consider expanding your search with fast growing stocks with high insider ownership.

With shares down from recent highs but analyst targets still above current prices, the question for investors is whether Coinbase remains undervalued or if its future growth is already reflected in today’s market valuation.

Most Popular Narrative: 31% Undervalued

With the narrative setting a fair value well above the recent $263.95 close, Coinbase is attracting attention for its perceived upside potential in a rapidly changing landscape.

Proprietary blockchain platforms and integrated payment solutions enable ecosystem lock-in and drive a shift toward higher-margin services and recurring revenue streams. Heavy dependence on trading amid falling volumes, rising cybersecurity and compliance costs, competitive fee pressures, and uncertain diversification threaten revenue stability and earnings predictability.

Want to know what revenue growth, profit shifts, and bold product bets are behind this call? The secret sauce: high-margin dreams plus a disruptive business model. Hit the link to see the formula and the risks nobody’s talking about.

Result: Fair Value of $382.56 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing sector volatility and fierce competition among exchanges could quickly undermine bullish forecasts and weaken Coinbase’s growth outlook.

Find out about the key risks to this Coinbase Global narrative.

Another View: Multiples Point to a Different Story

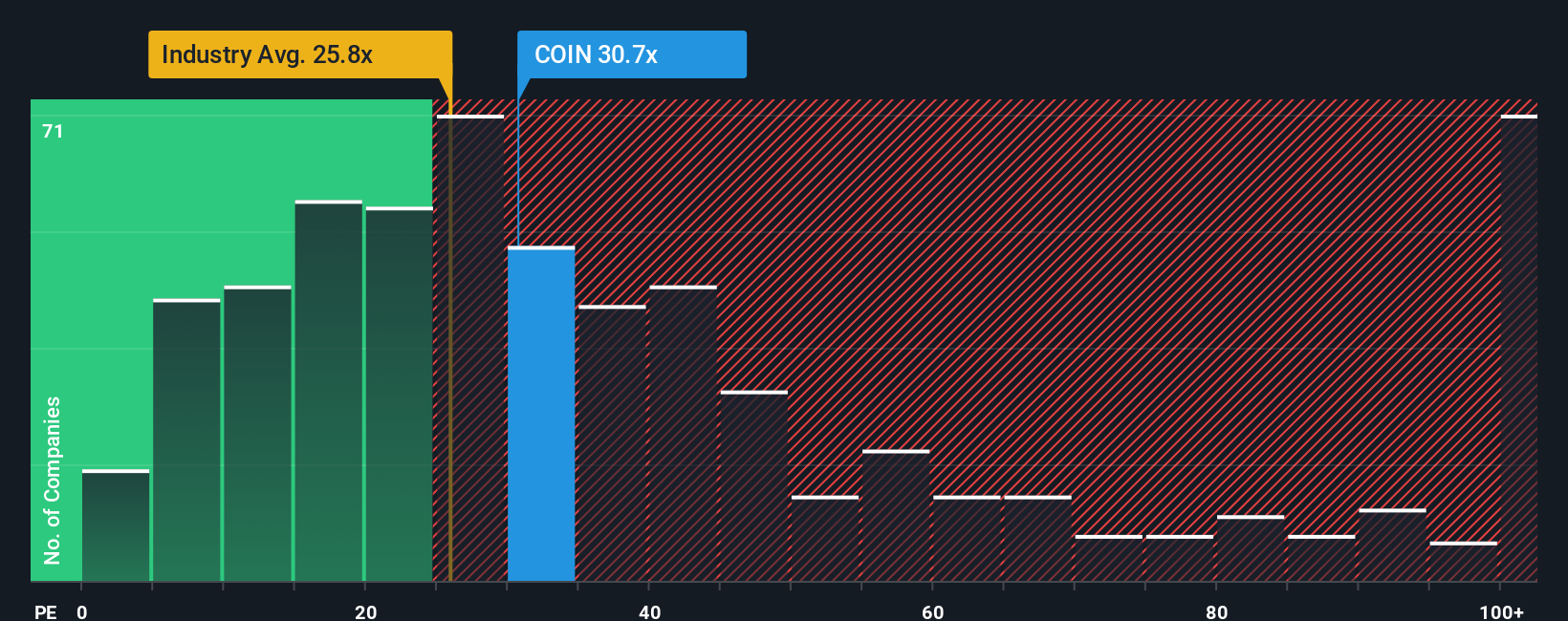

While the narrative-based valuation paints Coinbase as deeply undervalued, looking at its price-to-earnings ratio offers a more mixed picture. Coinbase trades at 22.1x earnings, cheaper than industry and peer averages (24.9x and 30.5x), but above the fair ratio of 19.7x. Does this suggest untapped upside, or are investors overlooking valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you’d rather trust your own convictions or question the narrative, dive into the data and craft your own perspective in just a few minutes, then Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next big winner could be hiding in plain sight. Don’t let unique opportunities pass by. Make your next move by checking out these hand-picked trends from the Simply Wall Street Screener:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com