See our latest analysis for Sherwin-Williams.

Despite a fairly quiet news cycle, Sherwin-Williams shares have trended slightly lower, reflecting a modest shift in market sentiment. While the 1-year total shareholder return sits at -11.6%, the longer-term three and five year returns of 42% and 44% show the company’s ability to deliver value to patient investors even as recent momentum fades.

If these market moves have you thinking bigger, it might be the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

Now, with shares trading below Wall Street’s price target and recent fundamentals showing steady growth, the big question for investors is whether Sherwin-Williams is undervalued or if the market has already factored in its future prospects.

Most Popular Narrative: 14.1% Undervalued

Sherwin-Williams ended the session at $332.18, while the most popular narrative points to a fair value 14% higher. This hints at optimism about how growth plans and margin improvements could reshape the near-term outlook for the stock.

Heightened investment in targeted customer-facing growth initiatives during a period of competitor retrenchment, layoffs, and price disruptions in the industry is likely to accelerate share gains with professional contractors and commercial projects, supporting long-term topline growth substantially above industry averages.

What is really powering this bullish estimate? It all comes down to aggressive revenue growth, ambitious margin expansion, and a future earnings multiple that stands out for this industry. If you want to see the precise financial forecasts that support this upbeat narrative, some may surprise you, read the full story now.

Result: Fair Value of $386.52 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent weak demand across key sectors and ongoing supply chain pressures could limit Sherwin-Williams’ upside, despite the current optimism in forecasts.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Market Multiples Tell a Different Story

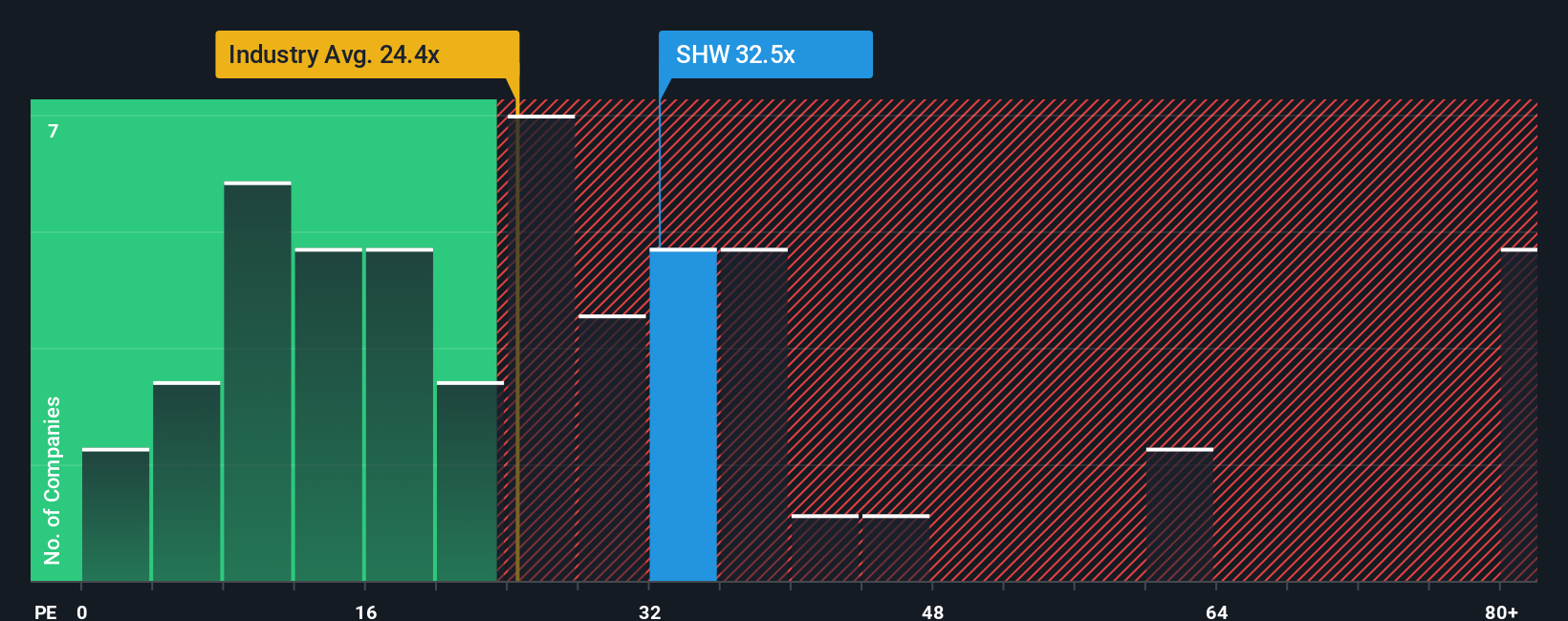

Looking at Sherwin-Williams through the lens of its price-to-earnings ratio, the shares appear expensive. At 31.8 times earnings, the company trades at a considerable premium to both industry peers (24.2x) and the broader US Chemicals sector (23.4x). The fair ratio of 24.2x suggests there could be downside risk if market sentiment hardens. Does this premium truly reflect unique strengths, or does it leave little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If you see the story differently or enjoy hands-on research, you can analyze the details yourself and craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your investing strategy by tapping into unique market trends and hidden opportunities that others might overlook. Take action now or risk missing the next breakout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com