Market snapshot

- ASX 200: +0.2% to 8,834 points

- Australian dollar: -0.1% at 65.2 US cents

- Wall Street: Dow Jones (+1.2%), S&P 500 (+0.3%), Nasdaq (-0.2%)

- Europe: FTSE (+1.2%), DAX (+0.5%), Stoxx 600 (+1.3%)

- Spot gold: +0.1% to $US4,129/ounce

- Oil (Brent crude): -0.2% at $US65.05/barrel

- Iron ore: +0.3% to $US102.50/tonne

- Bitcoin: +0.4% to $US103,114

Price current around 12:30pm AEDT

Live updates on the major ASX indices:

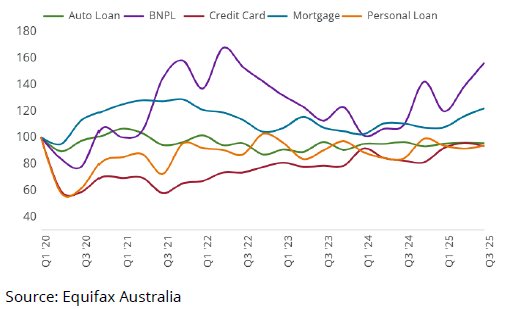

Buy Now, Pay Later applications up more than 40%

Credit ratings agency Equifax says Buy Now, Pay Later applications rose 43% in the September quarter, compared to the same quarter the previous year.

“The spike in BNPL accounts in attributable to the 10 June legislative changes. Because this segment is now reporting under the same requirements as other lenders, we are getting a fuller picture of its true reach, therefore I expect this growth to plateau over the next few quarters,” said Kevin James, chief solution officer at Equifax.

Demand for other types of credit also increase this quarter.

- Mortgage applications were up 10 per cent in the September quarter, the strongest growth since 2021

- There has been the largest volume of First Home buyer enquiries since 2022

- Credit card applications rose 13%

- Personal loan applications rose 11.6%

If you look at the purple line on this graph, you can see how popular Buy Now, Pay Later loans are compared to other types of credit.

BHP ordered to pay miners for working over Christmas

Mining giant BPH has been penalised more than $80,000 for forcing workers to work over Christmas without penalty rates.

In 2019, 85 miners were told they would have to work at a central Queensland mine on Christmas and Boxing Day with no special rates to be paid.

The workers described feeling “shattered” and “racked with guilt” for having to leave their families on the days, according to court documents.

The Mining and Energy Union took has won a court case arguing it was a breach of the Fair Work Act.

Home renovations near record highs

More households are choosing to renovate rather than move, due to rising home prices says the Housing Industry Association.

ABS Lending Indicators data for the September quarter 2025 show the value of lending for renovations is almost three times higher than it was pre-pandemic.

“This growth in renovations works is facilitated by the rise in home prices and low unemployment,” said Tim Reardon, HIA Chief Economist.

“The high price of land has seen many households choose to renovate to gain additional space to accommodate a growing family. This has seen renovations activity growing twice as fast as the rest of the economy.”

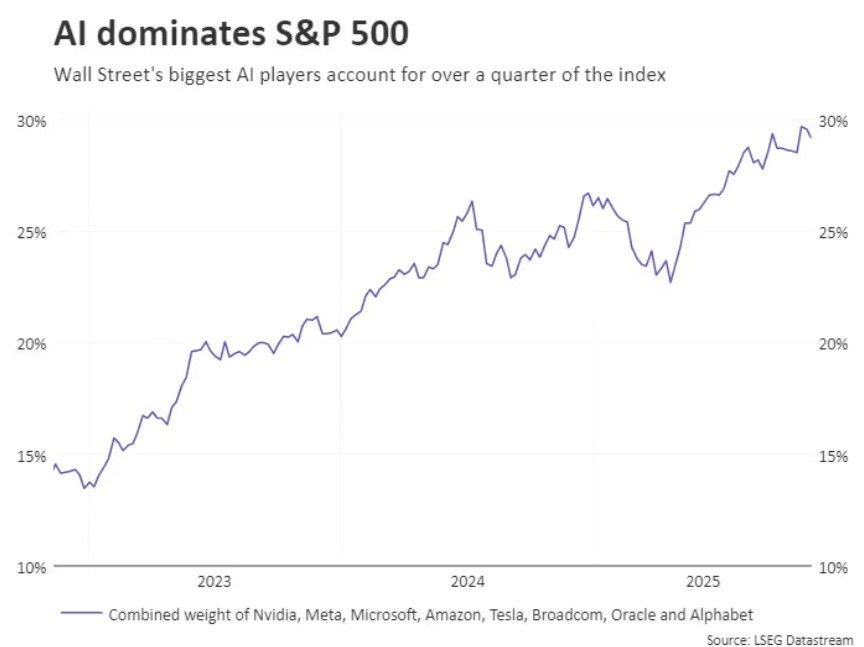

Nvidia and a small group of AI companies dominate Wall Street

If you’re interested in seeing how much America’s tech giants dominate the US stock market, I’ve got the perfect chart for you!

Eight companies — Nvidia, Meta, Microsoft, Amazon, Tesla, Broadcom, Oracle and Alphabet — make up around 30% of the value of S&P 500 index!

Two years ago, these companies (the major players in the ‘artificial intelligence trade’) were collectively worth about 15% of the US market.

So when these stocks have a bad day, they have a significant impact on Wall Street (and most superannuation funds, which have exposure to US shares). That’s the risk when a stock market is heavily concentrated in a select few AI companies.

In the past couple of years, the share price of these companies have skyrocketed on expectations their profits will continue to surge.

Lately, the value of AI-related stocks have fallen from record-high levels due to concerns they may be overvalued (or potentially in a bubble)!

Menulog will offer redundancy packages

Food delivery company Menulog says it will cease operating in Australia in two weeks’ time.

In an online statement, the company urged customers with any unused credits or vouchers were urged to use soon.

Around 120 employees would be affected and “eligible couriers” would be entitled to a four-week voluntary payment.

You can read more on this story here:

Why is Life360 falling today?

Why is 360 being sold off?

– Robyn

Thanks for your question Robyn.

It’s weird isn’t it.

Life360, which is an app that allows you to track family members, announced record third quarter results yesterday, even beating analyst expectations.

CEO Lauren Antonoff says more families are trusting the app.

However, monthly active users were lower than expected, at 91.6 million.

So why did shares drop yesterday and continue to fall today?

It’s probably due to the $184 million acquisition of Nativio, an advertising technology firm.

That deal has raised concerns around privacy and how Life360 plans to monetise the app’s data.

The core offering of the business is around providing safety, so analysts fear brand reputation risk.

Life360 shares are down -12.4 per cent as at 1:34pm (AEDT).

Greens write to bank regulator asking for investor lending crackdown

Greens Senator Barbara Pocock is writing to the banking regulator APRA and Treasurer Jim Chalmers, urging intervention to temper a surge in lending to property investors.

ABS figures released this morning showed a record $39.8 billion of loans were approved for property investors, out of a total of $98 billion in new home loans over the quarter.

That means investors now make up more than 40% of the home lending market nationally, levels only seen during previous investor-led property booms.

“First-home buyers don’t stand a chance in a housing market rigged against them,” said Senator Pocock in a statement.

“House prices have risen at the fastest rate in four years as rates of home ownership have declined, especially among young people (with home ownership amongst 25-29-year-olds dropping from 50% in 1971 to 36% in 2021).

“We need to urgently rein in an overheated credit market for property investors. APRA has intervened before and they must do it again. They must slow property investor lending as they did in 2014 and 2017 to great effect.”

In response to that previous house price and lending boom, APRA introduced a “speed limit” of 10 per cent per annum for property investor loan growth at institutions regulated by it (all those that take deposits, such as banks, building societies and credit unions).

Those restrictions started being wound back as the property market cooled in 2018.

Union calls for food delivery companies to protect gig workers

The Transport Workers’ Union is calling for Menulog’s workers to be prioritised as the app shuts down.

Its exit follows the collapse of Deliveroo and Foodora.

“This will be a shock to the thousands of food delivery riders who rely on Menulog for income,” says TWU national secretary Michael Kaine.

“We will be working to ensure those workers receive pay for their work and fair exit payments over the coming week.”

The union praised Menulog for supporting legislation which was introduced by the federal government last year to set standards for the gig economy.

“In the gig economy, workers are still languishing with below-minimum wage rates, no sick leave or superannuation, and deadly pressure to rush to make a living and avoid being deactivated,” Mr Kaine says.

“Menulog wanted to do the right thing by its workforce but years of regulatory neglect by Coalition governments has meant that change has come too late.”

Mr Kaine urged the remaining food delivery players — UberEats, DoorDash, Hungry Panda and Easi — to support the standards.

Investor lending surges to record high as housing market booms again

There’s no doubt that investors are a key driver of the latest nascent boom in Australian home prices, as confirmed in ABS lending data released today.

September quarter home loan commitments (excluding refinancing) jumped 9.6% in the September quarter to $98 billion, seasonally adjusted.

Investor lending surged 17.6% to a fresh record of $39.8 billion, or just over 40 per cent of loans by value.

Owner-occupiers were also jumping into the property market, but the increase for this segment was a much more modest at 4.7% over the quarter.

Maree Kilroy, a senior economist at Oxford Economics Australia, expects the numbers to balance out a bit in the current December quarter, with the federal government’s expanded 5% deposit scheme taking effect from October 1.

“The December quarter is set to show a strong increase in first home buyer demand given the commencement of the expanded Australian Government 5% Deposit Scheme last month, which anecdotally has seen a strong take-up,” she says.

“Housing demand is responding forcefully to the cumulative 75 basis points of interest rate cuts since February, alongside generous first home buyer policies and limited advertised stock.

“While the next rate cut now appears a while off following a stronger inflation read and hawkish commentary from the RBA, we expect price momentum will be sustained near term.

“We expect the national median home price will end 2025 up at least 8%.“

According to the ABS, there was growth in the number of investment loans across all states and territories: New South Wales (19%), Victoria (18.5%), Queensland (11.9%), Western Australia (9.1%), South Australia (7.1%), Australian Capital Territory (27.8%), Tasmania (10.6%) and the Northern Territory (5.1%).

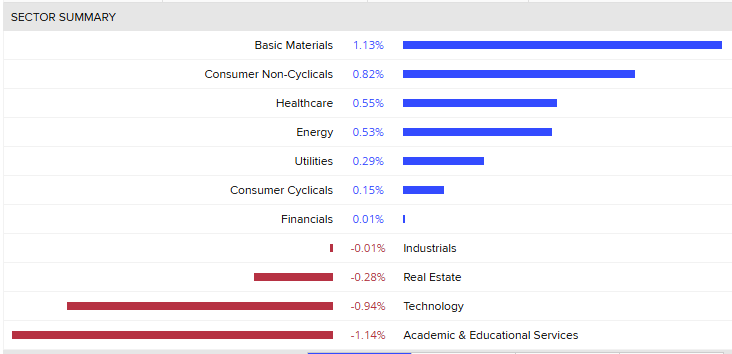

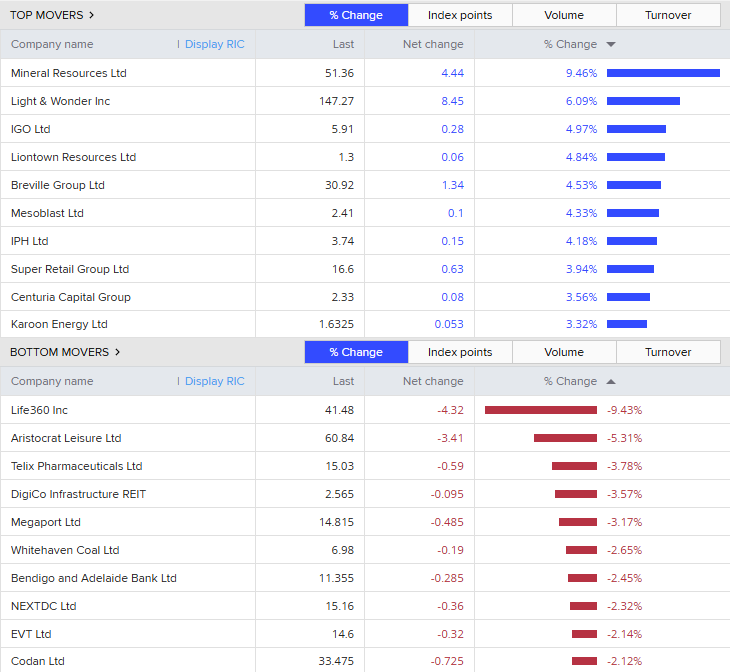

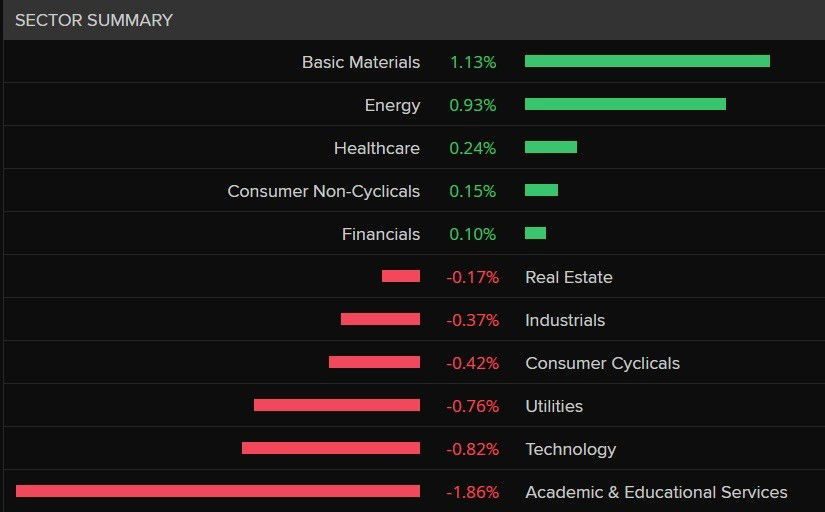

Let’s take a look at local share markets now

It’s looking pretty flat on local markets today.

The ASX200 is up just 0.2% at 8,833 points (as at 12:30pm AEDT) while the broader All Ordinaries index is up 0.2% as well, to 9,113 points.

Basic materials, consumer non-cyclicals, health care and energy are all positive sectors today, with technology and real estate in the red.

In terms of individual stocks, Mineral Resources continues to lead the way, up 9.5%.

It comes after the company announced a $1.2 billion deal to sell a 30% stake in its lithium business to South Korea’s POSCO as it seeks to cut debt and repair its balance sheet.

Life360 is leading the worst performers today, down -9.4%.

It follows a sell off yesterday after the family tracking app delivered record third quarter results, as well as a $184 million deal to buy Nativio, an advertising technology firm.

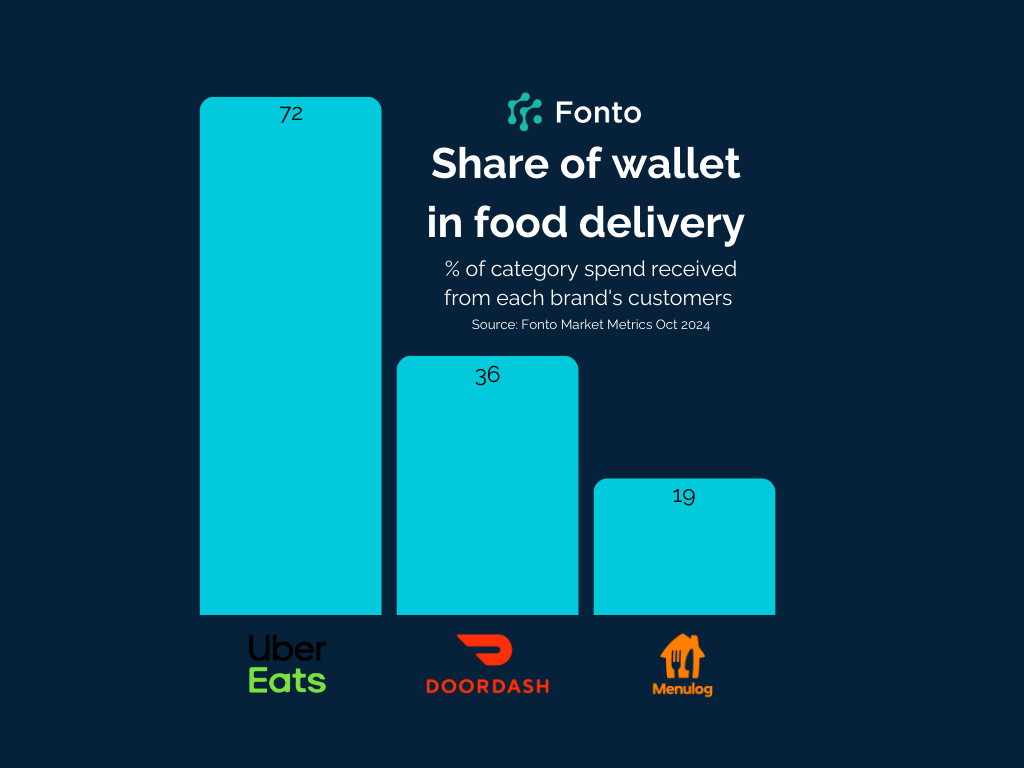

Food delivery market share — who are the big players?

UberEats dominates the food delivery service in Australia, with more than 70 per cent market share, according to market research firm Fonto.

Take a look at this chart, which shows the three main players.

Fonto says Menulog’s market share has been in steep decline since 2022, when it held 24% of the market.

This is despite the new initiatives it launched in 2024, such as waiving delivery fees for 100 days and supporting OzHarvest’s Unite to Feed Australia initiative.

Hello there

Thanks, David, for keeping us updated on all the market news this morning.

I’m Emily Stewart, and I’ll be with you this afternoon.

Our reporters are finding out more details on the announcement Menulog is shutting down — so more on that soon.

Loading

Farmers angry as Woolworths imports US butter in green and gold packaging

Australian dairy farmers are concerned consumers are being misled by cheap American butter being sold in Woolworths supermarkets.

The imported US butter is sold under the Hillview brand in the major supermarket and packaged in green and gold.

Exclusive to Woolworths in Australia, the butter has raised the ire of farmers and consumers, who have criticised it for its white colouring and bland flavour.

“It hardly even looks like butter,” Australian Dairy Farmers president Ben Bennett said.

“It’s white and somewhat different, and we want to be genuine about the product that we have and where it comes from.

“[Woolworths] promote themselves as the ‘fresh food people’, and getting food from the other side of the world when we produce it here stretches the rubber band a little bit.”

For more, here’s the story by Warwick Long and Justine Longmore.

Menulog to close down, with 120 employees losing their jobs

Food delivery company Menulog has just revealed it will shut down in two weeks.

Here’s what its Dutch parent company, Just Eat Takeaway, said:

“After careful consideration, we have made the difficult decision to cease our operations in Australia.

“While Menulog has a proud 20 year history, it has been navigating challenging circumstances. This strategic decision reflects our focus on accelerating growth and investments in other markets and to deliver the best experience for customers, partners and couriers.

“Altogether, this will impact approximately 120 employees.

“All impacted employees will be fully supported with generous redundancy packages above legal requirements and outplacement support.

Menulog will no longer accept orders from midnight, Wednesday 26 November 2025.“

Mineral Resources signs $1.2 billion deal with POSCO for lithium joint venture stake

Mineral Resources has entered into a deal to sell a 30% stake in its lithium business to South Korea’s POSCO for $1.2 billion ($US765m) as it seeks to cut debt and repair its balance sheet, sending its shares to a more than one-year high.

The diversified miner and mining services provider is seeking to climb out of a debt hole caused by large capital spending on its Onslow Iron haul road project and a collapse in lithium prices that hit earnings.

It has also been beset by corporate governance concerns surrounding its founder and CEO Chris Ellison.

For POSCO, which already has a joint venture lithium hydroxide project in South Korea with Australian lithium miner Pilbara Minerals, the deal marks its first foray into Australian lithium mines at a time when prices of the commodity remain low.

Shares of MinRes gained as much as 10.8% in early trade, hitting their highest level since October 11, 2024.

The deal will create an incorporated joint venture that will hold MinRes’ existing 50% ownership in the Wodgina and Mt Marion lithium mines, giving POSCO an indirect 15% interest in each of the projects, MinRes said on Wednesday.

The company will remain the mines’ operator under its existing agreements with the respective partners.

Lithium price recovery

In August, prices of hard rock spodumene, the lithium-bearing mineral, rebounded to about $US880 a tonne from a fall to four-year lows near $US610 a tonne in mid-June, but remain well short of 2022 peaks above $US6,000.

The decline in the prices pushed Australian miners to mothball operations and more recently to consider disposing of assets to rebuild their balance sheets.

In November 2024, MinRes put its Ball Hill lithium mine in Western Australia on care and maintenance.

In August, it posted an annual net loss after tax of $896 million and reported debt of $5.3 billion, a 21% rise from the prior financial year.

MinRes said it expected to use the proceeds from the POSCO deal to repay external debt, fortify its balance sheet and position the company for its next phase of growth.

MinRes, Flight Centre, gold and oil stocks among today’s best performers

It’s shaping up to be a great day for stocks of Australia’s mining and oil companies.

Mineral Resources is today’s best performer after its share price jumped 9.2%. The Perth-based company has signed a deal with South Korea’s POSCO to sell a 30% stake in its lithium business for $1.2 billion ($US765m).

Flight Centre shares jumped 2.7% after it gave shareholders a rosy financial forecast.

The travel company said it was expecting to earn an underlying profit of $305 million to $340 million in the current financial year (which is up to 18% higher than last year’s result).

Stocks of gold miners like Evolution Mining (+2.8%) are in high demand after the precious metal’s spot price rose firmly above $US4,100.

Meanwhile, shares of Karoon Energy (+4.8%) and Viva Energy (+3.1%) have risen sharply after a jump in the oil price overnight.

Materials and energy sectors drive ASX slightly higher

On this relatively flat trading day, it’s the materials and energy sectors which are keeping the ASX 200 afloat.

However, there are more sectors in the red with technology (-0.8%), utilities (-0.4%) and consumer discretionary (-0.4%) seeing the steepest losses.

The sell-down in Australia’s tech sector is consistent with what happened on Wall Street overnight — with the Nasdaq Composite (dominated by technology giants) falling 0.3% this morning.

Australian Statistician says he’s not going anywhere

Our top numbers person, Australian Statistician David Gruen, is being asked about the US, where some statisticians and leaders were booted by the Trump administration for delivering “bad” job numbers.

“We do have arrangements that are pretty strong [compared to the US],” he says.

“I’m appointed by the Governor-General, not the [government].

“In light of recent events, I did read up on this,” he adds, filling the room with laughter.

He just has to stay solvent. If he’s bankrupt, he can be booted.

Dr Gruen says he has “no plans” to go bankrupt.

ASX opens marginally higher following mixed performance on Wall Street

The Australian share market is off to a cautious start and has risen very slightly in morning trade.

The ASX 200 index was practically flat, having risen 0.1% to 8,827 points by 10:20am AEDT.

It comes after the Dow Jones’ jumped more than 1% to hit a record close on Wall Street this morning.

However, investors sold down their value of AI tech giants like Nvidia, which dragged the Nasdaq Composite slightly lower.

So far, mining and energy companies are driving the gains on the local market, but that’s being offset by losses across banks and tech stocks.

I’ll have more details for you shortly!