See our latest analysis for Waste Connections.

Over the past year, Waste Connections has seen a total shareholder return of -9.7%, in contrast to its longer-term record of solid gains. The company posted a 3-year total shareholder return of nearly 26% and a 5-year return above 60%. After a slow start to the year, recent modest share price moves suggest investors are weighing near-term challenges against the company’s steady growth track record.

If you’re thinking beyond waste management and want to see what else is gaining momentum, now might be the perfect time to discover fast growing stocks with high insider ownership

With steady earnings growth and a share price still trading below analyst targets, is Waste Connections offering a compelling entry point for new investors, or is the market already reflecting expectations of future gains?

Most Popular Narrative: 19.1% Undervalued

With Waste Connections closing at $166.18, the most widely followed narrative assigns a fair value of $205.36, signaling a notable gap between sentiment and market price. What is driving this bullish outlook? The quote below holds a key clue.

Margin expansion is seen as a key driver of future valuation upside. Improvements are attributed to increased employee retention and strategic investments in technology and infrastructure, which could bolster long-term price management and efficiency.

Want to know why analysts are betting on rising profits despite market headwinds? It all centers on bold assumptions about margin gains and a future earnings metric rarely seen in this sector. Curious what numbers power this ambitious valuation? Read the full story to see what the narrative is projecting behind the scenes.

Result: Fair Value of $205.36 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, severe weather and ongoing commodity price swings still pose meaningful risks, potentially challenging Waste Connections’ path to sustained margin and revenue growth.

Find out about the key risks to this Waste Connections narrative.

Another View: Market Multiples Paint a Cautious Picture

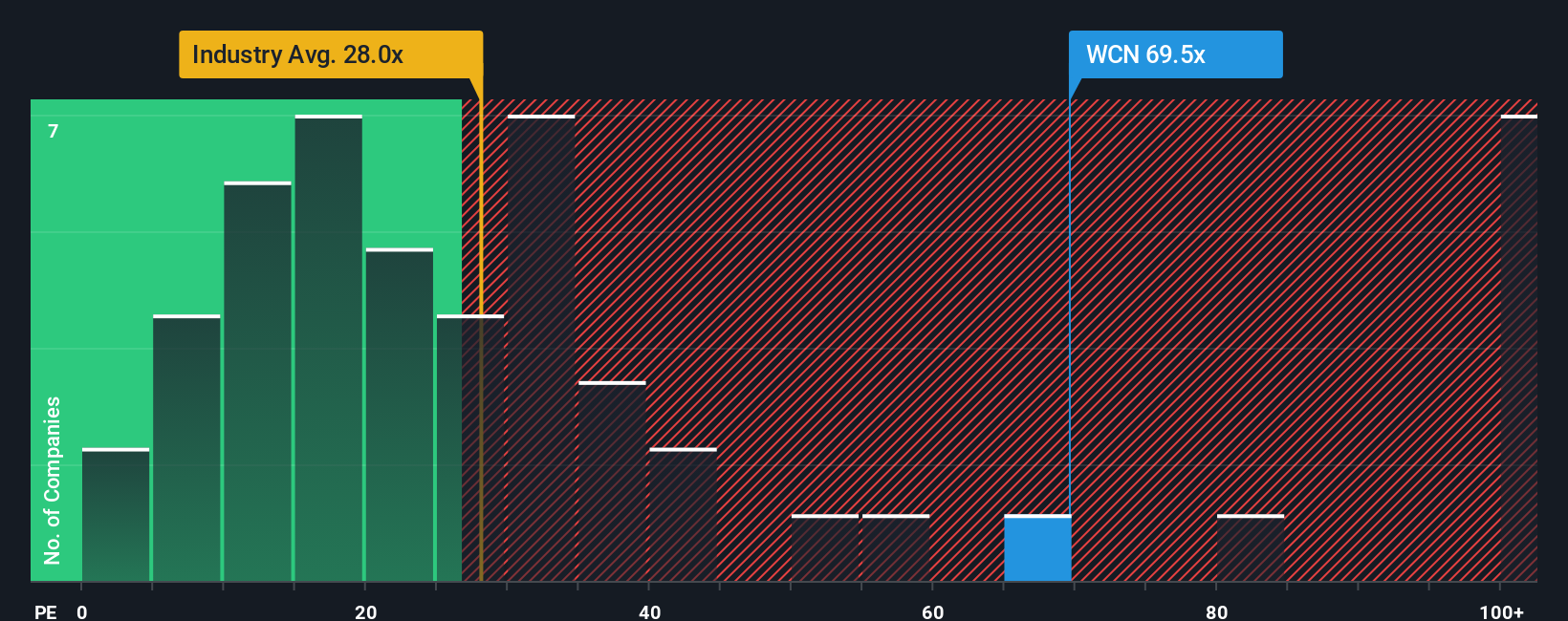

While the analyst narrative points to significant upside, the company’s price-to-earnings ratio stands at 68.4x, which is roughly double the peer average of 36x and much higher than the industry average of 22.2x. Even compared to its fair ratio of 34.2x, the current valuation looks expensive. This suggests potential valuation risk if market sentiment changes. Should investors be wary of relying too heavily on future growth projections?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

Feel free to dive deeper into the numbers and shape your own perspective. Crafting a personalized Waste Connections narrative takes just minutes. Do it your way

A great starting point for your Waste Connections research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors seize every advantage, so don’t limit yourself. Tap into specialized lists tailored to unique strategies and breakthrough industries that others may overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com