SnapInspect’s latest integration with AppFolio (APPF) is bringing real-time property inspection data and automated workflows directly into the AppFolio Stack Marketplace. This development could make day-to-day operations faster and more efficient for property management teams, which may increase client satisfaction and support long-term platform adoption.

See our latest analysis for AppFolio.

AppFolio’s new integration with SnapInspect arrives against a backdrop of recent share price softness, with the stock closing at $228.08 after a 4.28% pullback in the last day and an overall year-to-date share price return of -8.07%. While short-term share price momentum has faded, the company’s longer-term outlook remains striking. AppFolio boasts a 94.99% total shareholder return over three years and 58.15% over five years, suggesting that investors with patience have been well rewarded even through bouts of volatility.

If news about automation in property management sparks your interest, it could be worth discovering See the full list for free..

After this recent dip, should investors view AppFolio as undervalued with room to run, or is the market already factoring in all of the company’s future growth potential?

Most Popular Narrative: 28.1% Undervalued

Compared to AppFolio’s last close at $228.08, the narrative sets a much higher fair value. This suggests there is a disconnect between market sentiment and the expectations built into the narrative calculation. This highlights the importance of understanding the growth assumptions that shape that bullish perspective.

Accelerating adoption of AI-powered workflow automation within property management, demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions, positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

Want to unravel how AppFolio’s valuation could skyrocket? The main ingredient is ambitious revenue growth forecasts and profit margins that could surprise the sector. Which future benchmarks must be hit to justify such a premium? Find out what’s fueling the optimism by reading the full narrative.

Result: Fair Value of $317.20 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing margin pressure and heavy reliance on domestic growth could present real challenges for AppFolio’s long-term bullish narrative.

Find out about the key risks to this AppFolio narrative.

Another View: What Price Multiples Reveal

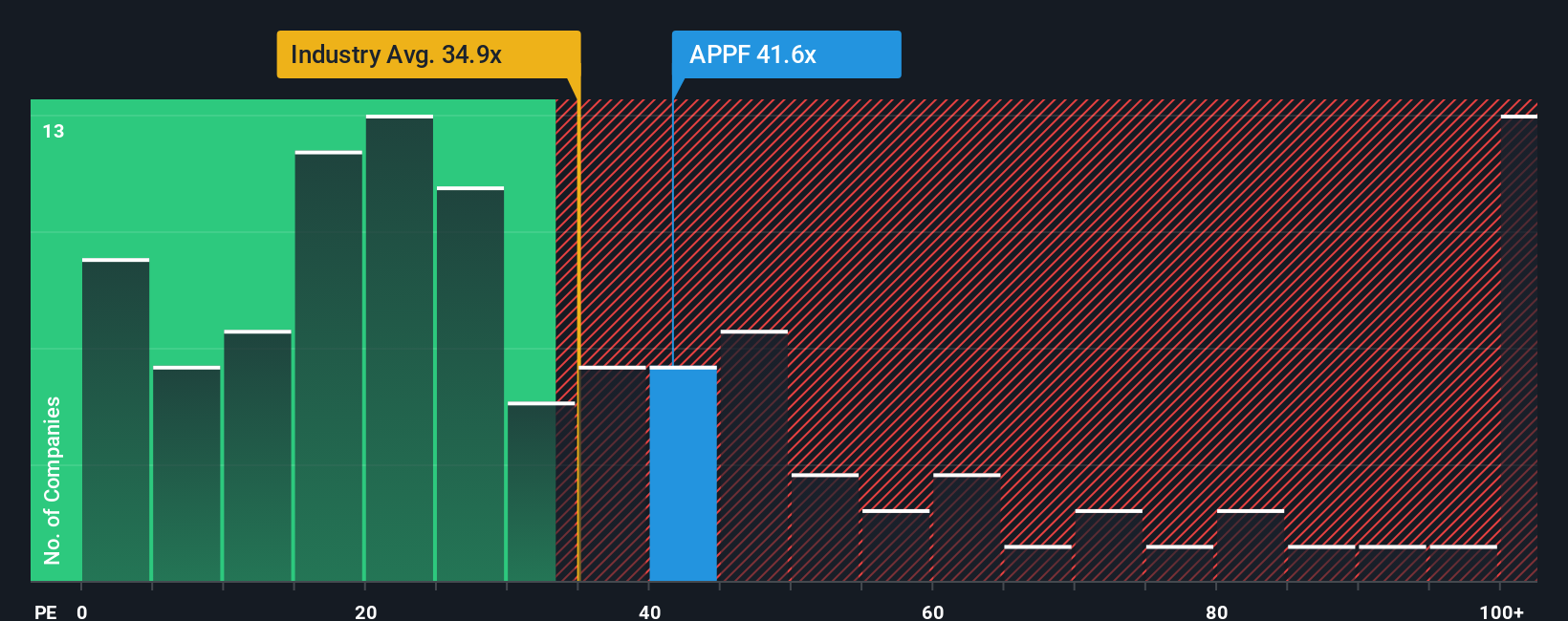

Looking beyond fair value estimates, AppFolio trades at a price-to-earnings ratio of 40.2x. This is noticeably higher than both the US Software industry average (30.8x) and its closest peers (28.8x), and well above the market’s fair ratio of 28x. Such a premium suggests investors are paying up for growth. What if the market decides the business should be valued more in line with its sector or fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppFolio Narrative

If you have a different take on AppFolio’s outlook or want to explore your own insights, you can assemble a personal narrative in just minutes using our tools. Do it your way.

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t just stop with one opportunity. Head over to the Simply Wall Street Screener and grab your front-row seat to what’s next in tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com